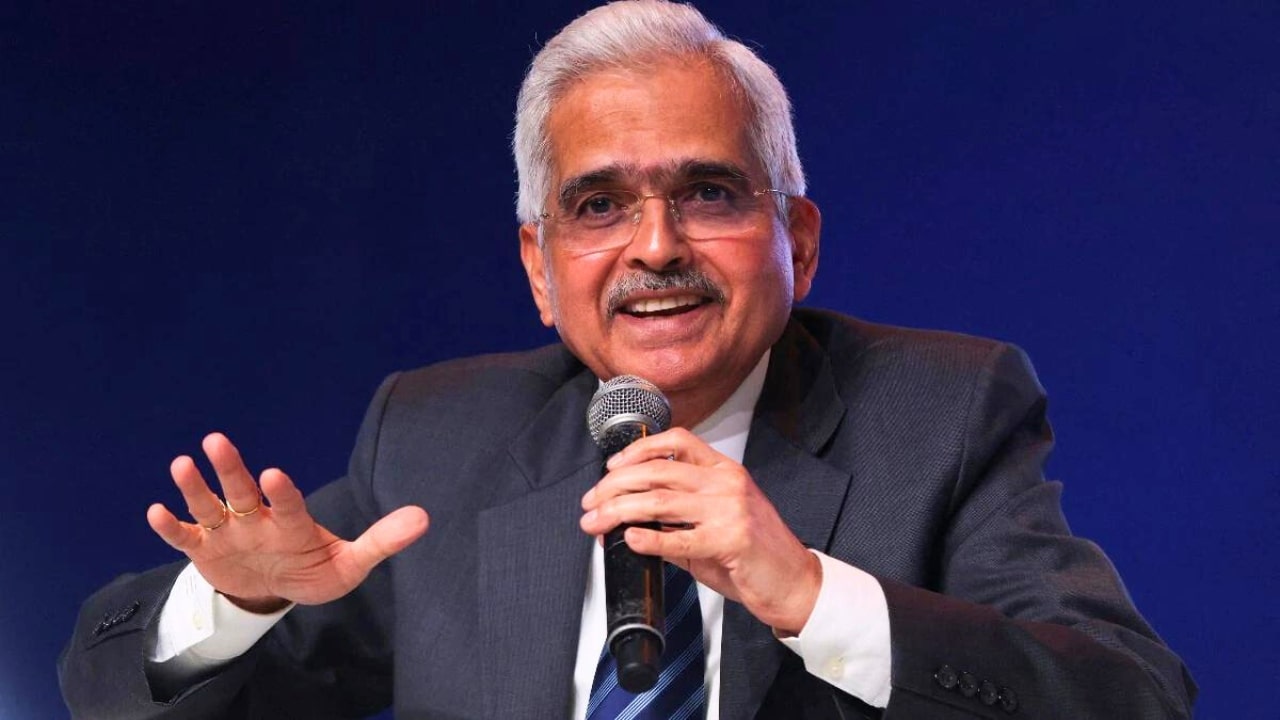

RBI News Update: There is no relief from expensive loans and expensive EMIs for the time being. Reserve Bank of India Governor Shaktikanta Das has said that due to instability in the economic environment and the inflation rate being close to 5 per cent, it would be premature to talk about a reduction in interest rates.

In an interview with CNBC-TV18, Shaktikanta Das said the economic situation in the whole world, including India, remains uncertain. In such a situation, it would not be right to talk about a reduction in interest rates. He said that the retail inflation rate is still close to 5 percent. According to the surveys, the inflation rate may remain close to 5 percent.

In such a situation, it would be premature to talk about a reduction in interest rates. The RBI Governor said I will not give any wrong guidance because market players, stakeholders and others start riding the wrong train.

The governor said there is a reason for this stance of RBI. RBI has set a target of bringing the inflation rate to 4 percent, and at present, the inflation rate remains close to 5 percent. He said we hope it will come down, and it has started coming down. But the pace of reduction in inflation is very slow. Shaktikanta Das said if the inflation rate has to be brought closer to the target soon, then the monetary policy will have to be more stringent.

The RBI Governor said we did not do this because we must maintain a balance between growth and inflation and are gradually moving towards our target. The RBI Governor said we are far from the target of 4 percent.

The RBI had decided not to change the monetary policy issued on June 7, 2024, and the repo rate has been kept at 6.50 percent. The retail inflation rate data will be announced on July 12, which the market will watch.